45L tax credit for energy efficient homes

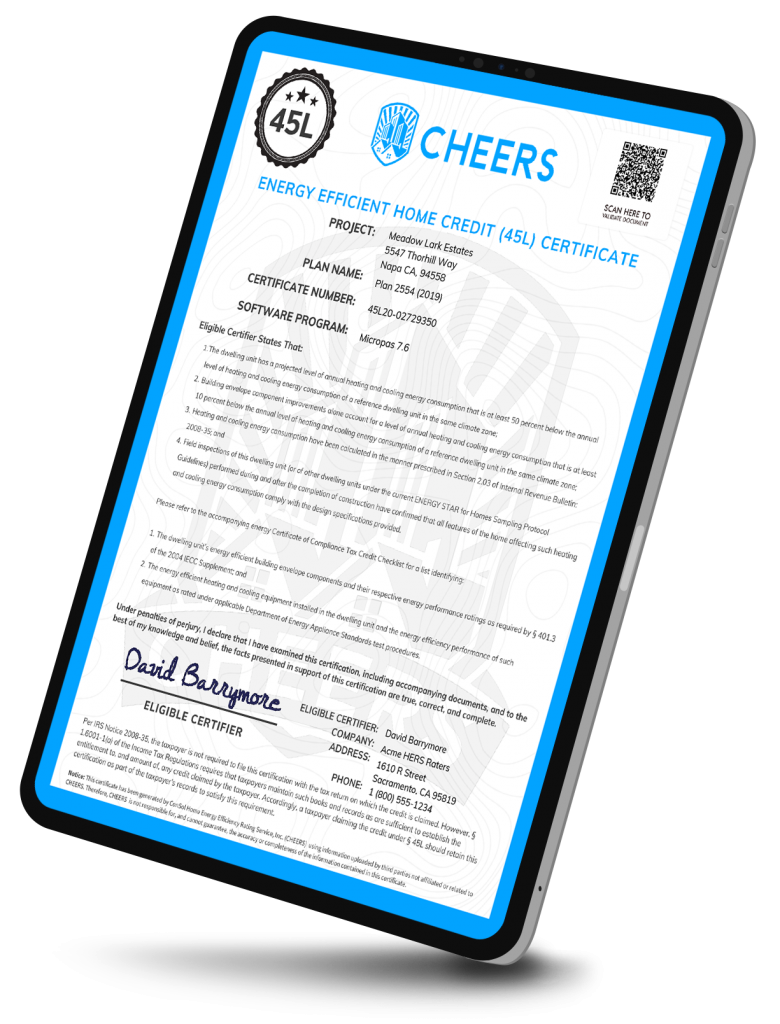

Create certificates for the $2,000 45L tax credit. Projects registered with CHEERS are automatically evaluated for energy savings eligibility with Micropas, a U.S. Department of Energy approved 45L software.

Why use CHEERS for 45L?

45L Plan Pre-Qualification

- A value add for Energy Consultants and Designers to their builder clients

- Documentation demonstrates the energy plan design will be eligible for the $2,000 45L tax credit when constructed

45L Certificate Package

- HERS Raters create and sign the 45L certificate as the Eligible Certifier

- Builders use this package as supporting documentation when claiming the $2,000 tax credit

- Typical fee to builder to complete tax credit work is $200-$500 per lot. This includes the CHEERS certification package

Customized Pricing

- Design a custom package for your business

- Available for businesses with large 45L or registry volume

- Volume discounts, multi-product discounts; contact us for a quote

45L tax credit overview

Under the provisions of the 45L New Energy Efficient Home Tax Credit, builders and developers may claim a $2,000 federal tax credit for each new home or dwelling unit that meets 45L energy efficiency requirements. Most new California homes qualify for this $2,000 credit.

The California 45L process

CHEERS is California’s largest registry for California Building Energy Code (Title 24) compliance. Each project uploaded to CHEERS for energy code registration is instantly evaluated for 45L qualification via Micropas, a Department of Energy approved 45L software. A 45L certificate package is made available for review and download if the project meets the 45L energy savings requirements.

45L tax credit basics

The 45L credit is federal tax incentive that promotes the construction of energy efficient residential buildings. The credit is available to builders, developers and others who build homes for sale or lease.

To qualify for the $2,000 tax credit, an eligible “dwelling” must:

- Be at least 50% more efficient than the 2006 IECC benchmark. Efficiency compliance must be verified with DOE approved 45L software, such as Micropas.

- Have the energy features verified by a qualified HERS Rater (Eligible Certifier)

- Be sold or leased prior to January 1, 2023

Most California residential building projects qualify for this credit by building to current California code. California’s progressive Building Energy Code (Title 24) is substantially more stringent than 2006 IECC.

45L in CHEERS for

Energy Consultants:

Energy Consultants:

45L in CHEERS for

HERS Raters:

HERS Raters:

Frequently asked questions

The person claiming the 45L credit on their tax return must own and have a basis in the qualifying project during its construction. A “person” can be an individual, a trust, an estate, a partnership, an association, a company, or a corporation. Most entities currently claiming the 45L credit are homebuilders and developers.

The IRS terminology refers to this person as an “Eligible Contractor”. This is sometimes confusing as the credit is available to the person who financed and owned the project during construction, not the third-part contractor(s) who were paid to build it.

A key requirement of the tax credit is the sale (close of escrow) or lease (executed lease/rental agreement) of the home or dwelling units during the taxable year the credit is claimed. The credit is typically not available a person eventually residing in the home.

IRS Form 8908 is used to claim the 45L tax credit.

Micropas is energy modeling software used to verify compliance with the energy efficiency requirements of the IRS 45L tax credit. Developed by Enercomp, Inc. Micropas has been used by national builders throughout the country since the inception of the 45L tax credit in 2006. Micropas has been seamlessly integrated into the CHEERS Registry; your energy files are automatically checked for 45L qualification as they are uploaded for California energy code compliance.

Micropas has been reviewed and approved for 45L tax credit use by the U.S. Department of Energy and can be found on the DOE’s Approved Software list:

As the Energy Consultant on the project, you determine what building energy features will be used to comply with California Building Energy Code (Title 24). Energy Consultants can provide an additional, valuable service to their builder, developer, and architect clients by designing the project energy features to also meet 45L efficiency requirements.

During energy file upload for CF-1R registration, the CHEERS registry also evaluates the energy design for 45L qualification via DOE / IRS approved Micropas v7.6. The results are made available immediately. If the project’s energy design meets the 45L efficiency requirements, a 45L Pre-Qualification documentation package (including certificate and 45L analysis results) is made available for download and distribution to your client.

Energy Consultants typically charge an additional $50-200 per plan for this 45L pre-qualification process.

The 45L tax credit provides developers of energy efficient homes and apartment buildings up to $2,000 per dwelling unit. Most projects built to 2016 and 2019 California energy code already exceed these standards and qualify for the 45L tax credit.

For 45L purposes, a HERS Rater acts as the “Eligible Certifier” for the project and generates the 45L Certificate documentation the project owner needs to claim the tax credit.

HERS Raters typically charge an additional $200-500 per dwelling unit to provide this 45L documentation.

This person is who the IRS defines as the “Eligible Certifier”. This is typically the project’s HERS Rater.

The Eligible Certifier can not be an employee of the person or entity claiming the 45L tax credit. The Eligible Certifier must be accredited to use energy performance measurement and testing methods. Certified HERS Raters meet this criteria. More information is available at IRS Notice 2008-35 on the IRS website.

Nope, no cost at all. Simply upload your energy file to CHEERS and we’ll tell you the 45L qualification results immediately.

There is a cost associated with creating and downloading a 45L pre-qualification package. This package documents a plan’s energy analysis results via DOE/IRS approved software and is a valuable service Energy Consultants and other energy design professionals provide their builder and developer clients.

No problem at all. Projects registered or HERS tested in another registry can be re-uploaded to CHEERS for 45L certificates only.

In this case, upload the XML energy file originally used for CF1R registration to CHEERS. If the project energy features meet the 45L efficiency requirements, a 45L certificate will be made available to the HERS Rater for review, signature and download. No other CF2Rs or CF3Rs need to be completed.

No, the 45L Tax Credit is per home (per address). The credit does not depend whether other homes in the project qualify.

Most newly constructed, detached ADUs qualify for the 45L tax credit if they are used for rent or lease.

Energy Consultants – When possible, follow these guidelines to ensure your ADU energy calcs meet the 45L energy efficiency requirements:

- Model as performance new construction, detached

- Use a single zone

- Model as single orientation; be cognizant of south and west facing glazing

- Take advantage of the QII credit

Yes. In general, tax filings can be amended up to three years from the date of the tax filing. For instance, if a builder filed

their 2018 taxes on 4/15/19, they usually have until 4/15/22 to file a tax amendment to claim the credit. Please consult with a tax advisor regarding your or your client’s specific needs.

Yes. Under 45L, a $1,000 – $2,000 credit is also available for an eligible contractor with respect to a manufactured home. The manufactured home must have a projected level of annual heating and cooling energy consumption that is at least 30-50% below the annual level of heating and cooling energy consumption of a reference dwelling unit in the same climate zone. It must also conform to the Federal Manufactured Home Construction and Safety Standards.

If you have 50+ of these dwellings you would like to qualify for the $1,000 – $2,000 45L tax credit, please contact sales@cheers45L.com.

Yes, for some projects. If you have questions about 45L tax credits for multi-family projects, please contact sales@cheers.org.

CHEERS does not provide tax or accounting advice. Please consult with your tax and accounting advisors for 45L guidance specific to your situation.